Water enterprises' breakthrough during the 15th Five-Year Plan period: Do things what are difficult but right -- A Paradigm Revolution from Scale Expansion to Value Reconstruction

As of the time of writing (May 12, 2025), except for some Hong Kong-listed companies, the listed companies within the industry have released their 2024 financial reports. Overall, for the 84 companies that have disclosed their annual reports, the total assets have slowly climbed with a year-on-year growth rate of 3.15%. However, the operating revenue has dropped sharply, with a year-on-year decline of 4.11%. The net profit has suffered a significant shrinkage of 16.89%, and the average net profit margin has further decreased to 9.73%. The median value of PB (Last Year Ratio) has been under pressure and dropped to 1.42. The continuously expanding asset scale, along with the increasingly meager profits and valuations, presents a stark contradiction that directly hits the pain points of the industry: The traditional development paradigm of the water industry has reached its ceiling.

01

Pain Point of Water Enterprises:

Is there still growth? Are they still making money? Are they still valuable?

Reviewing the investment in environmental governance in China, from 2006 to 2020, it advanced vigorously with a double-digit compound growth rate. A large number of significant policies were introduced frequently, continuously driving the growth of industry investment. Industry labels such as franchise operation and "guaranteed profit" were highly favored by capital. Driven by policies and supported by capital, a number of excellent enterprises emerged in the golden age, such as Capital Eco-Pro Group, Beijing Enterprises Group, Guangdong Holdings, Grandblue Environment, Chongqing Water & Environment, etc., achieving breakthrough development in terms of scale, business format, region and other aspects.

However, when analyzed in segments, it is clearly visible that the growth rate and increment of environmental governance investment have both decreased, dropping from the peak growth rate of 27% during the 11th Five-Year Plan period to 3.64% during the 13th Five-Year Plan period. Since the 14th Five-Year Plan period, it has turned downward, with an average annual decline of 4.13% from 2021 to 2023.

From the perspective of the market, the changes in the project structure also show the same characteristics. By comparing the winning bid situations in the municipal water affairs field in 2022 and 2024, it can be seen that, first, there are fewer "big projects". The proportion of the total amount of projects worth over 1 billion yuan has decreased by 10%, and the average project amount has decreased by 380 million yuan. The proportion of the total amount of projects worth over 500 million yuan has decreased by 5.8%, and the average project amount has decreased by 30 million yuan. Second, there are fewer "good projects". The proportion of the total amount of investment projects has decreased by 16.1%, and the average amount has decreased by 260 million yuan. The proportion of the total amount of engineering projects has increased by 14.7%, and the average project amount is only 60 million yuan. Among the listed companies, which are the outstanding group in the industry, the average operating revenue also declined by 4.11% in 2024. The three giants, Capital Eco-Pro Group, Beijing Enterprises Group, Guangdong Holdings, were unable to maintain growth.

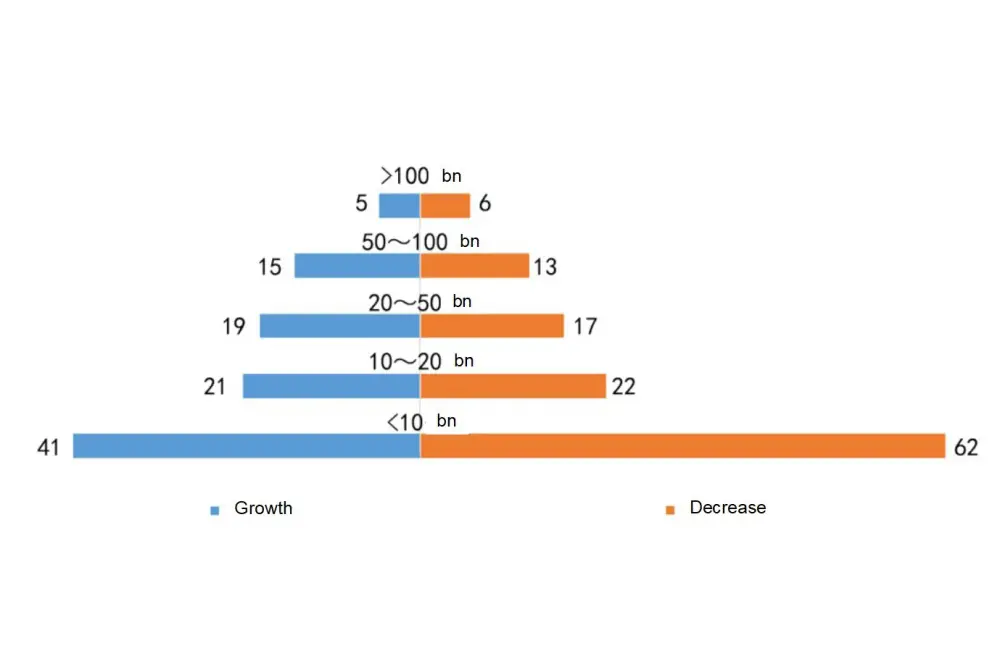

In terms of profitability, it's like "Wang Xiaoer spending the Chinese New Year - getting worse year by year". During the 14th Five-Year Plan period, the average net profit of listed water enterprises has been continuously decreasing, with a compound growth rate of -13.69%, and the net profit margin has declined all the way to 9.73%. Among the 84 listed water enterprises, 51 have negative profit growth, accounting for more than 60%, including 8 turning into losses and 10 expanding their losses.

From the perspective of market valuation, when compared horizontally among 31 major industries (classified according to Shenwan classification, excluding comprehensive industries), listed environmental protection companies (including water enterprises) rank 10th in terms of average net profit margin, 23rd in terms of price-to-book ratio, and last in terms of average market value. The price-to-book ratio (LYR) of listed water enterprises has continuously declined to 1.43, and a large number of enterprises in the industry are on the verge of "trading below book value" or have already done so. Owning a large amount of assets but getting the evaluation of "being able to make money but not being valuable" has become the biggest pain for listed companies in the industry. Especially against the backdrop of state-owned enterprises strengthening the assessment of market value for listed companies, it is really a headache.

All of the above are just concentrated manifestations of the pain points of the industry's development, and the actual feeling is far beyond that. A large number of problems such as water prices, asset structure, accounts receivable, and interest-bearing liabilities have overwhelmed the enterprises in the industry, and due to space limitations, they will not be elaborated one by one here. Precisely because of this, there are voices of pessimism in the industry. Some peers have communicated with us about whether we should still persevere. In response to this, our answer is:

Both the investment growth rate of -4.13% and the revenue growth rate of -4.11% are obvious negative signals. However, the slowdown or negative growth in scale is inevitable as the industry develops into the stock operation stage. It is more of a signal of a qualitative change in the market form rather than a "downturn" signal. After the full coverage of infrastructure, we have officially entered the "post-infrastructure era", and the traditional growth paradigm has become ineffective. Instead of being blindly anxious, it is better to base ourselves on the present and think about what kind of water enterprises are needed by the times and what is the development paradigm in the new era.

02

Confusion:

The Uncertainty about Growth Modes and Paths

Since last year, we have successively received planning requirements from several water companies. Some are concerned about the impact of the tariff war on overseas expansion, some about the direction of the dual-carbon policy, some about how to implement AI in water plants, and some about market value management. The questions raised vary, but in essence, the core demands are highly consistent: how to develop in the new era? Or, to be more precise: how to achieve growth? How to make a profit? How to increase the value?

Our unified answer is that the first question should not be how to develop, but what kind of development should we pursue?

Looking back at the evolution of the industry's competitive landscape from 2016 to 2024, the first thing we notice is the principle of "the strong getting stronger". Among the leading enterprises, flagship companies such as Beijing Enterprises Group and Capital Eco-Pro Group. have formed a business layout of "one superpower with many strong players" and a regional layout with "multiple strongholds" relying on their strong market capabilities and capital strength, maintaining their scale advantages. With revenues reaching 5 billion yuan, 10 billion yuan, 20 billion yuan... they have continuously raised the scale threshold of the industry. Water companies in first-tier cities such as Beijing, Shanghai, Guangzhou and Shenzhen, relying on the locational advantages of super-large cities, have deeply engaged in the water business and made a full-chain layout, and have also successively broken through the 10-billion-yuan revenue mark. Provincial and municipal water companies, such as Chongqing Water & Environment, Chongqing XINGRONG Environment., Hongcheng Environment, Grandblue Environment, Zhongshan Public Utilities, and other mid-sized enterprises in the industry, have also achieved breakthroughs relying on their regional advantages. Through in-depth regional development, diversified development, or mergers and acquisitions and integration, they have maintained growth resilience through various means.

However, what we see is only the "glory on the surface". The actual situation is known only to those involved. By looking at the changes in specific indicators such as accounts receivable, interest-bearing liabilities, economic value added, return on net assets, and per capita revenue/profit, we can know that in fact, the development of many enterprises is neither healthy nor sustainable.

We do not deny this growth logic, and all of the above-mentioned enterprises are excellent. But standing at the current juncture, we raise the question: can we continue to grow in this way? Is it still possible for us to grow like this? The answer is actually quite clear.

In the picture of the industry's competitive landscape, there are also some "explorers" who are dedicated to specific niches. Let's take a look at two enterprises that ranked among the top 2 in terms of revenue growth in 2024:

In 2024, BGT Water's revenue increased sharply by 60%, and its net profit attributable to the parent company increased by more than 40%. The reason behind this is the salt lake lithium extraction layout in 2021. It won the core equipment bid section of the 10,000-ton lithium extraction project in the Zhabuye Salt Lake in Tibet, established a research and development base together with Zhabuye Lithium Industry Co., Ltd., and broke through the electro-adsorption lithium extraction process, laying the foundation for its leading position in the field of comprehensive development and utilization of salt lakes. In 2024, it achieved a lithium extraction revenue of 240 million yuan, turning the resource recycling of high-salt wastewater into a new growth pole for the company. In March of this year, it won the prospecting right of the lithium mine in Ruoqiang County, Xinjiang, extending the development chain of mineral resources and forming a synergistic effect of "lithium extraction associated ore development".

DAYU Irrigation also achieved a revenue growth of 27% in 2024, and its net profit attributable to the parent company increased by more than 60% year-on-year. DAYU has been focusing on digital water conservancy and providing comprehensive digital water conservancy solutions. Against the backdrop of record-high investment in national water conservancy construction, the company's annual orders reached 5.314 billion yuan. In particular, the construction of smart agricultural water projects has significantly increased, with revenue reaching 2.6 billion yuan, a year-on-year increase of 40%. The intelligent irrigation system it developed can achieve "a 40% water saving per mu and a 30% increase in production", and has been listed as a national promotion demonstration project by the State Council.

Of course, there are many similar enterprises, and we will not list them one by one. Such enterprises, either focusing on scene penetration or on technological breakthroughs, have shown us another possibility for development in the water industry, shifting our perspective from economies of scale to the "value of specialization". Looking further at international giants, according to statistics from the National Development and Reform Commission, from 2005 to 2015, the average return on equity (ROE) of projects of foreign water companies in China was 14.2%, while that of domestic enterprises in the same period was 7.3%. We can all feel more acutely than I can how much value lies in this 6.9% difference and how much accumulation and effort are required at the operation and technology ends.

While these newcomers are striving for breakthroughs, the revenues of most water enterprises still come from traditional water supply and drainage services and engineering. They are complaining about water prices, accounts receivable, the shrinkage of the industry space, and the fragility of the single value chain... Admittedly, we are indeed facing these problems, and it is understandable to complain a bit. But while complaining, can we also turn our attention to these small but beautiful fields and small but beautiful enterprises? In these fields, what can we do? We are not advocating giving up the traditional growth paradigm, but rather asking what else we can add on top of it.

03

Symptoms:

Path Dependence Deviating from the Laws

Is this something that the industry enterprises don't know? On the contrary, you all know it better than I do. However, the most terrible thing is right here - knowing but not acting, or even avoiding. Behind this logic lies the "path dependence" that goes against the market law and that all water enterprises must change.

Let's review the development paradigm in the golden age of the industry: policy - driven, capital - supported, and project - replicated.

Both municipal and environmental protection are costs to society. Therefore, policies and government investment have been the main driving factors for the past development of the industry and will also be one of the important driving factors in the future. The ability to better understand policies, strive for them faster, and even influence them earlier has become the core competence.

Infrastructure construction requires massive and continuous investment. Under the heavy - weight policies, a large number of projects were launched intensively, and with the combination of factors such as the incomplete supervision mechanism and the insufficient professional competence of the management institutions, "being able to invest" was equated with "doing well", and the enclosure movement with capital as the king became the "easy mode" of the industry's development. The development paradigm of "getting projects - contributing capital (equity capital) - financing - investing - engineering (reflux) - getting projects..." and the preference of capital for the "sure - win" industry attribute of franchise have further fueled the "investors" in the industry.

Therefore, the "easy mode" of relying on resources/policies of the industry enterprises especially state-owned enterprises has become the easiest path to replicate and also the path that everyone is most willing to replicate. However, it is obvious that this path is becoming more and more difficult. The reason is simple: because the traditional paradigm no longer matches the current market pattern. So, what is the pattern?

Returning to the typical logic of enterprise strategic thinking, we need to consider three elements: customers, competition, and ourselves, that is, market demand, competition strategy, and our own (resource) capabilities. Understanding customer demands, building our own capabilities, and winning market competition - this is the pattern. However, what we often see is the following:

Lack of a customer-oriented mindset. Franchising provides extremely good guarantees. Once a project is implemented, it is almost impossible to change suppliers, which leads to a lack of motivation to step out of the comfort zone. Project acquisition mainly relies on "connections" and funds, with a serious lack of consideration for customer demands and insufficient exploration of customer value. Instead, there is constant competition with customers. Just like a question we often pose to water supply companies: we possess a huge customer resource that is bound for a long term, which is something that many enterprises can only achieve at a great cost. However, what have we done? What value have we tapped into?

Caught in homogeneous competition. Under the traditional development paradigm, the competition methods of enterprises within the industry have gradually become similar. To cite a passage from《The 2024 Annual Report of the Eco-Environmental Protection Industry: What Problems Are We Facing?》: The main competitive advantages of leading enterprises are concentrated in aspects such as capital cost and government relations. The core of their business is large-scale expansion and rapid market occupation. And the relationship marketing spreads layer by layer, resulting in a significant gap between the supply chain capabilities of the entire domestic environmental protection industry and international powerhouses like Veolia and Suez. Almost all products and services of leading enterprises lack strong competitiveness, especially in traditional fields such as water affairs.

Lack of core competence. To quote a statement from the leader of an enterprise renowned for its high-level operation within the industry: "How can we make it clear to customers that we are better than others?... It is said that our operation is the core capability, but what does it mean in specific matters? Is it a set of standards? Or a set of processes?... What are the explicit and tangible things?...". Similarly, when we all claim that we have made certain innovations, what have we actually innovated? What are the explicit and tangible things? How can we demonstrate that we are stronger than others? In 2024, 80 listed companies invested 4 billion yuan in research and development expenses. How many of them have truly achieved remarkable results? Is there any technology that is leading the whole country or has brought about in-depth changes to the industry?

04

Way to Break the Deadlock

Constructing the Value Logic and Development Paradigm

In a nutshell, the core message is that the traditional paradigm has become ineffective. Looking towards the 15th Five-Year Plan period, we have only one task at hand—a paradigm revolution! A revolution against ourselves!

In general, the water industry is experiencing changes in three underlying logic and our new development paradigm is embedded within them currently:

Firstly, the shift in market demand drives a customer value revolution.

From infrastructure investment and construction to operation and maintenance, from major fields to minor ones, from municipal to industrial, and from developed regions to less developed regions, essentially, the easy and profitable tasks have already been completed. The traditional reliance on franchising, project-oriented thinking, and the inertia of scale expansion have become ineffective. Focusing on the operation stage with long-term and stable prospects is the right path.

However, the operation we are talking about does not simply mean reducing power consumption, chemical consumption, and the difference between production and sales. Instead, it requires in-depth exploration of customer needs, understanding of customer pain points, and the provision of customized solutions, which is the winning formula for long-term development.

For example, when the whole country is promoting the development of strategic emerging industries, as a water company, what products and services can we offer to these industries? Can we supply the ultra-pure water required for chip production and deal with the wastewater it generates? When facing hundreds of thousands or even millions of end customers, besides selling mineral water, what other high-value water products and services can we provide? When the whole country is developing new productive forces, how can water enterprises develop their new productive forces?

Secondly, the transformation of the action mechanism drives a revolution in the development model.

From BOT (Build-Operate-Transfer) to PPP (Public-Private Partnership) and then to EOD (Ecological-Oriented Development), the fundamental logic behind these is the change in the paying entity and the payment logic. The increasingly strict and professional regulatory requirements and governance performance reflect the awakening and changes of customers. Facing more complex and difficult environmental problems, there are demands for more comprehensive and efficient governance.

Correspondingly, for water enterprises, it means a systematic reconstruction of the business model and development model. Under the logic of scale expansion, the business model is to exchange scale for cash flow to achieve long-term benefits. However, when the payment ability of local governments is under pressure, this logic is bound to be broken and may even become a burden. When we shift to the logic of serving customer needs in exchange for high added value, it requires a deeper understanding of the market, more targeted solutions, more scenario-based product services, and more flexible and extensive industrial ecological connections... To achieve all these, we need a systematic reconstruction in aspects such as ideology, strategy, organization, and mechanism.

Thirdly, the change in competitive factors drives an ability revolution.

Once our cognition and thinking have changed, we need corresponding capabilities. For example, how can we reach out to customers? How can we explore customer needs? How can we get closer to customers? These may seem like requirements for marketing personnel, but in fact, they are issues related to the construction of organizational capabilities that the company needs to consider at the organizational and institutional levels. For another example, when Deepseek emerged during the Spring Festival, while everyone was asking various unrealistic questions about DS, Beijing Capital Air Environment Science and Technology quickly launched the full-version application of "AI + Ecological Environment" based on Deepseek, which reflects the"innovation ability of the enterprise.

There are many such examples. In order to better serve customers and adapt to the development requirements of the new era, water enterprises face higher requirements and challenges in all aspects, such as market expansion capabilities, capital operation capabilities, operation management capabilities, and scientific and technological innovation capabilities.

The logic of the traditional development paradigm of policy plus capital is still applicable, but other capabilities must be further added. Just as we have been appealing to everyone, the competitive factors in the industry are shifting along the path of capital - operation - technology. Have we kept up? In terms of operation improvement and technology enabling, what have we done? Is it sufficient to support us in dealing with the next round of competition?

05

Conclusion

Do Things That Are Difficult but Right

The so-called paradigm revolution has three remarkable characteristics: Firstly, it is non-gradual. It is not a process of accumulative gradual change but a comprehensive reconstruction of the worldview. Secondly, it is crisis-driven. The old paradigm can no longer explain the current phenomena, which triggers the revolution. Thirdly, it is social, requiring the collective acceptance of the new paradigm by society.

This is exactly the current situation we are facing. The traditional paradigm has become ineffective, and the crisis drives us to reform. It is not a simple, gradual reform but a breaking and reconstruction of the model. Moreover, all water companies need to reach a consensus and take action to promote the progress of the industry.

Revolution, especially the paradigm revolution, is destined to be painful, long-lasting, and repetitive. Coupled with the high uncertainty of the external environment, it is easier for us to lose our way and forget our original aspiration. In this profound transformation, the real game-changers need to possess two capabilities: One is the industrial strength to penetrate the fog of industry development, accurately grasp the direction, and the strategic determination to consistently implement it. The other is the ability to dig deep into customer pain points, reconstruct the value creation logic in ordinary operations, and truly create products/services that the industry and customers need.

Only enterprises that dare to break away from path dependence and reconstruct their models and capabilities can be reborn in this revolution of paradigm reconstruction. We should adhere to long-termism and do things that are difficult but right! We sincerely hope that all environmental protection enterprises can transform into new entities in this transformation.